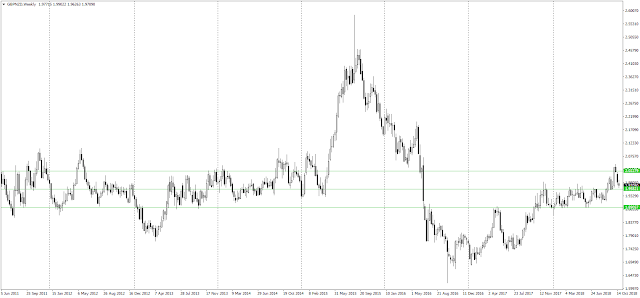

Multiple Timeframe Analysis for the Pair GBPNZD

1. Pair =GBPNZD

Major Support

2. Support Level =1.9580

Major Resistance

3. Resistance Level =2.0230

4. Extended Resistance level = 2.0850

Monthly Chart

Monthly Chart has been looked for overall direction.

Weekly Chart

Drawing Support and Resistance by slightly tilt the chart. We can clearly see the Resistance became support and it is retracing to the support level.

Circled are support and Resistance bounced. This chart is Zoomed of the previous and looking close to understand the movement.

previous Weekly chart - but removed cirlce and drawn line just to understand the market movement as well as to understand the trend.

zoomed out again to undertand more detail. it is same Weekly Chart.

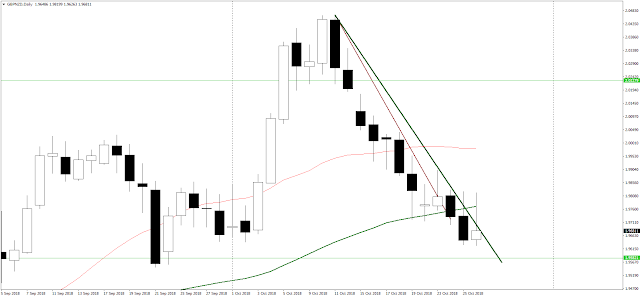

Daily Chart

from the above chart we can clearly see that the range has been break out and forming higher high and higher low

Trendline has been drawn. once the Trendline is breakout than it will be assume that -the market is in Buy Zone. as long as the price is below the trend line the market is in sell Zone. but overall market is bullish so we have to find the opportunity to buy the market in order to ride the bull market.

Let zoomed it

as we can see that . it is trying to break out the trendline but not being able to. once it breakout by daily bar then we could find the opportunity for buying from the lower time frame. in this case i have been using 1 hour chart . let see the further process.

Hour Chart

and future movement

Green dotted line are future prediction.

once the trend line break out, multiple way can be used to enter the market for example breakout peaks and couter trend breakout (after each retracement) and many more.

Risk Reward:-

Must use stop loss to prevent excessive loss

Define Reward or pyramiding your position

Conclusion:- In Bullish Market, looking opportunity for buying and must be in the buy zone.