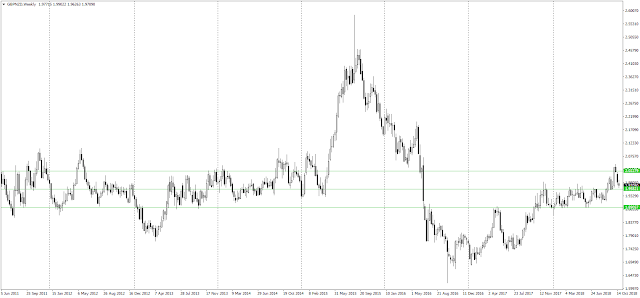

Multiple Timeframe Analysis for the Pair GBPNZD

1. Pair =GBPNZD

Major Support

2. Support Level =1.9580

Major Resistance

3. Resistance Level =2.0230

4. Extended Resistance level = 2.0850

Monthly Chart

Monthly Chart has been looked for overall direction.

Weekly Chart

Drawing Support and Resistance by slightly tilt the chart. We can clearly see the Resistance became support and it is retracing to the support level.

Circled are support and Resistance bounced. This chart is Zoomed of the previous and looking close to understand the movement.

previous Weekly chart - but removed cirlce and drawn line just to understand the market movement as well as to understand the trend.

zoomed out again to undertand more detail. it is same Weekly Chart.

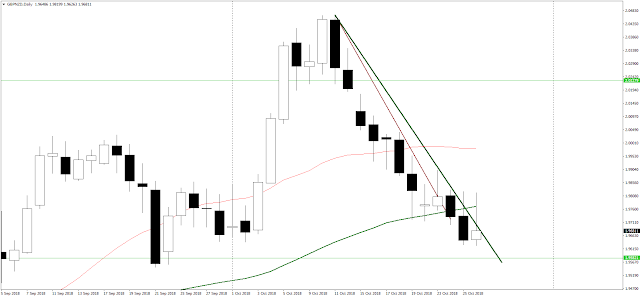

Daily Chart

from the above chart we can clearly see that the range has been break out and forming higher high and higher low

Trendline has been drawn. once the Trendline is breakout than it will be assume that -the market is in Buy Zone. as long as the price is below the trend line the market is in sell Zone. but overall market is bullish so we have to find the opportunity to buy the market in order to ride the bull market.

Let zoomed it

as we can see that . it is trying to break out the trendline but not being able to. once it breakout by daily bar then we could find the opportunity for buying from the lower time frame. in this case i have been using 1 hour chart . let see the further process.

Hour Chart

and future movement

Green dotted line are future prediction.

once the trend line break out, multiple way can be used to enter the market for example breakout peaks and couter trend breakout (after each retracement) and many more.

Risk Reward:-

Must use stop loss to prevent excessive loss

Define Reward or pyramiding your position

Conclusion:- In Bullish Market, looking opportunity for buying and must be in the buy zone.

Friday 26 October 2018

Monday 13 August 2018

How to make money using mutltiple timeframes anlysis for pair GBPAUD

Pair = GBPAUD

Market = Bearish Market

Opportunity = Selling Opportunity

Support

level = 1.8350

Level = 1.7590

Resistance

Level = 1.7100

Weekly Timeframe: overall direction is Bearish

we can see the significant supports and resistances including the bearish movement.

Daily Timeframes = To make a decision (Sell or Wait)

Market Start Moving down forming Lower high and Lower low including moving average crossed over.

Detail picture of the Daily Timeframe. Support became resistance that is level 1.7590

Once Fibonacci Retracement has been drawn,

we can clearly see that 50% fobo Retracement has made.

Time Frame = 1 hour Timeframe ( to execute the order)

In 1 hour timeframe , Retracemnt is underway respecting the Trendline towards resistance level 1.7590

once the trendline breakout we could make execute the order.

Note:- This Multiple Timeframe anslysis is only for eductional purpose.

Market = Bearish Market

Opportunity = Selling Opportunity

Support

level = 1.8350

Level = 1.7590

Resistance

Level = 1.7100

Weekly Timeframe: overall direction is Bearish

we can see the significant supports and resistances including the bearish movement.

Daily Timeframes = To make a decision (Sell or Wait)

Market Start Moving down forming Lower high and Lower low including moving average crossed over.

Detail picture of the Daily Timeframe. Support became resistance that is level 1.7590

Once Fibonacci Retracement has been drawn,

we can clearly see that 50% fobo Retracement has made.

Time Frame = 1 hour Timeframe ( to execute the order)

In 1 hour timeframe , Retracemnt is underway respecting the Trendline towards resistance level 1.7590

once the trendline breakout we could make execute the order.

Note:- This Multiple Timeframe anslysis is only for eductional purpose.

Tuesday 31 July 2018

Monday 30 July 2018

Monday 23 July 2018

Multiple Timeframe Analysis for the Pair GBPJPY

Pair -GBPJPY

Support Level

Major Support level = 139.70

Minor Support level = 145.40

Resistance Levels

Major Resistance Level= 156.80

another strong resistance level = 147.40

Timeframes Use= Weekly, Daily and Hourly

Weekly Timeframe has been used to spots the Support and Resistance.

Daily Time that has been used to get possibities of movement -Up or Down but strong Conviction is

UP

Daily Time Frame Use to Understand the Sell Zone that is below the trendline and buy Zone that is above the Trendline. Trendline is break out and form Higher high and higher low (possiblities) even Fibonacci Retracement has reached or retrace at level 61.8 (following Picture)

Daily Timeframe made me a decision to look for a buying opportunity. It has been Retracing and retrace level at 61.8

I have spotted - it has retraced and break out the trendline.

Conclusion:-

execute - long position

stop loss - 10 pips below the turning point i.e 145.56

Profit Target is 147.50 or fellow the trend and move stop loss until stop out.

Risk Disclaimer

Trading any financial assets can be a challenging and potentially profitable opportunity for investors and Traders. However, before deciding to participate in the Financial Market, you should carefully consider your investment objectives, level of experience, and risk appetite.

Support Level

Major Support level = 139.70

Minor Support level = 145.40

Resistance Levels

Major Resistance Level= 156.80

another strong resistance level = 147.40

Timeframes Use= Weekly, Daily and Hourly

Weekly Timeframe has been used to spots the Support and Resistance.

Daily Time that has been used to get possibities of movement -Up or Down but strong Conviction is

UP

Daily Time Frame Use to Understand the Sell Zone that is below the trendline and buy Zone that is above the Trendline. Trendline is break out and form Higher high and higher low (possiblities) even Fibonacci Retracement has reached or retrace at level 61.8 (following Picture)

Daily Timeframe made me a decision to look for a buying opportunity. It has been Retracing and retrace level at 61.8

I have spotted - it has retraced and break out the trendline.

Conclusion:-

execute - long position

stop loss - 10 pips below the turning point i.e 145.56

Profit Target is 147.50 or fellow the trend and move stop loss until stop out.

Risk Disclaimer

Trading any financial assets can be a challenging and potentially profitable opportunity for investors and Traders. However, before deciding to participate in the Financial Market, you should carefully consider your investment objectives, level of experience, and risk appetite.

Wednesday 18 July 2018

Technical Analysis for the Pair EURJPY - Multiple Timeframe Anlysis

Pair - EURJPU

Trend - Uptrend

Support levels

Major Support level = 126.90

Minor Support level = 130.30

Resistance Level

Major Resistance Level = 136.10

Charts

Monthly - To know the Direction/ to know the support levels and Resistance levels

Daily - To find the trend and make decision - Buy or Wait

Hourly - To Execute the positon / Entry point, Exit point

First Two Charts are montly

then Two Charts are daily

final Chart is 1 hour Char

Conclusion:

once the Trendline break out and there is bullish momentum then we can take long postion at level 130

Update:

Finally EURJPY has completed the Retracment and break out the Trendline.

Daily Time frame shows that retrace level is 76.4

Same Picture of Daily Time frame. but we ccan see that trend line is break out and moving up to acheive the edge

Conclusion:

Make sure about the proper Stop loss and profit taking methods have been applied.

Trend - Uptrend

Support levels

Major Support level = 126.90

Minor Support level = 130.30

Resistance Level

Major Resistance Level = 136.10

Charts

Monthly - To know the Direction/ to know the support levels and Resistance levels

Daily - To find the trend and make decision - Buy or Wait

Hourly - To Execute the positon / Entry point, Exit point

then Two Charts are daily

final Chart is 1 hour Char

Conclusion:

once the Trendline break out and there is bullish momentum then we can take long postion at level 130

Update:

Finally EURJPY has completed the Retracment and break out the Trendline.

Daily Time frame shows that retrace level is 76.4

Same Picture of Daily Time frame. but we ccan see that trend line is break out and moving up to acheive the edge

Conclusion:

Make sure about the proper Stop loss and profit taking methods have been applied.

Monday 16 July 2018

Technical Analysis for the Pair NZDJPY - By Using Multiple Timeframes

First of all, we need to find out Support and Resistance. Regarding the Pair NZDJPY i have been using weekly and Montly chart to find out the support, Resistance and Trend. In this particular charts i have found that level 75.75 as a support and Resistance levels are 79.80 and 83.20.

if we look at Daily Timeframe Down Trend is exist

Possibilites

1. If it does break out and form Higher High and Higher low in Daily Timeframe then it takes rally to the level 79.80 further leve 83.20

2. If downtrend continues and Retest Level 75.75 then it will go down to level 68.90

Conclusion

As weekly chart shows that the level 75.75 is Significant Support which might be hard to break. At that level it has been many times bounce backed. It is possible level to turn to up.

if we look at Daily Timeframe Down Trend is exist

Possibilites

1. If it does break out and form Higher High and Higher low in Daily Timeframe then it takes rally to the level 79.80 further leve 83.20

2. If downtrend continues and Retest Level 75.75 then it will go down to level 68.90

Conclusion

As weekly chart shows that the level 75.75 is Significant Support which might be hard to break. At that level it has been many times bounce backed. It is possible level to turn to up.

Thursday 5 July 2018

Financial Market Terminology

Financial Market Terminology

1. Spread

2. Ask/Sell Price

3. Bid/Buy Price

In the following Picture, Ask/Sell price is 1.5430(4)

and Bid/Buy Price is 1.5432(5) the

price difference between Buy and Sell is called Spread. Where end of the numbers (4)and (5) are called points in the forex. If

price move from 1.5430(4) to 1.5431(6) which is 1 pip and 2 points move

In the example below

current market price for Share A is £11.50. if you want to buy that particular

share then you need to Pay £11.55 instead of £11.50 just because of Spread, the

price difference between Market Price and Bid price is called spread. Similarly if you want to sell then you will

get £11.45 instead of £11.50, the price difference between Market Price and Ask

price is called Spread.

Types of Order

In the Financial

Market, the terms Buy, Sell, Buy Stop, Sell Stop, Buy Limit, Sell Limit are

come to use. In this section, These terms will be explained.

Buy/ Buy Stop/ Buy Limit:

Buy price normally

assume the Market Price. In the example below, market price is £11.50 (Red

Line). If you want to buy the Share A at Market Price you will have to pay £11.50.

If you want to buy Share

A when the price will be at £11.80 by hoping the price will go up then you need

to place Buy Stop order. Let’s say your market price is at £11.50 and have

placed Buy Stop Order at £11.80 by hoping the price will rally. If it does not

reach £11.80 then your order will not execute. Only your order will execute

once it reaches the level £11.80.

If you want to buy Share

A when the price will be at £11.00 by hoping the price will retrace and go up

then you need to place Buy Limit order. Let’s say you have place Order at £11.50

(Market Price) hoping the price will retrace the level £11.00 and would like to

buy at that price, is called Buy Limit Order. If it does not reach level £11.00

then your order will not execute. Only your order will execute once it reaches

the level £11.00.

Sell/ Sell Stop/ Sell Limit

Sell price normally

assume the Market Price. In the example below, market price is £11.50 (Red

Line). If you want to sell the Share A at Market Price you will get £11.50.

If you want to Sell Share

A when the price will be at £11.20 by hoping the price will down (or to protect further losses) then you need

to place Sell Stop order. Let’s say your market price is at £11.50 and have

placed Sell Stop Order at £11.20 by hoping the price will down (or to avoid more losses). If it does not

reach £11.20 then your order will not execute. Only your order will execute

once it reaches the level £11.20.

If you want to Sell Share A when the price will

be at £12.00 by hoping the price will retrace and go down then you need to place

Sell Limit order. Let’s say you have place Order at £11.50 (Market Price)

hoping the price will retrace the level £12.00 and you would like to sell at

that price, is called Sell Limit Order. If it does not reach level £12.00 then

your order will not execute. Only your order will execute once it reaches the

level £12.00.

In the Financial Market, Buy Stop order, Buy Limit Order, Sell Stop Order, Sell Limit Order are used for opportunity to get the best price and protect the losses. These Orders are automated once you filled which can execute without presence in the market.

Subscribe to:

Posts (Atom)